Navigating the volatile waves of cryptocurrency markets demands skill and insight. A clear grasp of how to use technical indicators for crypto can mean the difference between random luck and strategic gain. I’ll show you step by step how to empower your trades with these essential tools. First, we’ll break down the raw signals in price patterns and volume data. Ready to stop guessing and start winning? Let’s dive into the charts and shape your success!

Understanding The Foundation of Crypto Chart Analysis

Identifying Patterns and Trends

You want to win in crypto trading? Know the charts. Seeing patterns and trends is key. A chart can show a coin’s whole story. It’s like a map to treasure, but you need to read it right. When you spot a trend, you’re finding the way coins usually move. Think of trend lines as your crypto compass. They guide you; where the price might go next.

You’ve seen hills and valleys, right? In charts, they are peaks and troughs. They’re clues. They tell you if prices could go up or down. By drawing lines that connect these highs and lows, you create what we call ‘support’ and ‘resistance zones’. Support is where the price might not drop below. Resistance is where it might not go above. Just like how a roof stops you from jumping too high or a net from falling too low.

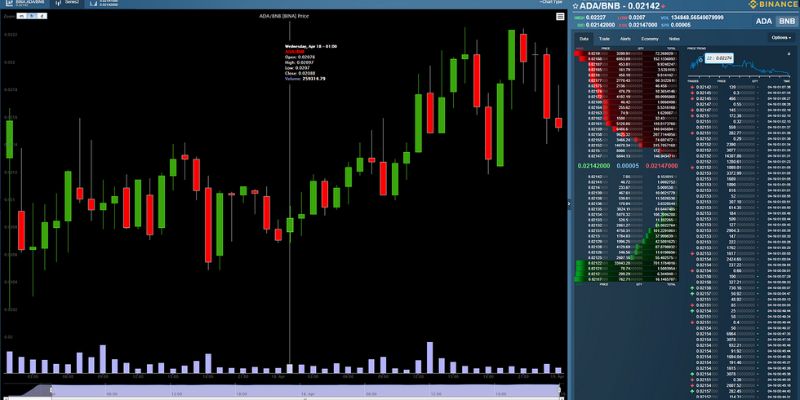

Now, how to tell if a trend is strong? Look at volume. More volume means more traders believe in the price move. They’re like your friends who help push your car when it’s stuck. If lots of them push, the car moves far. If few of them help, it might not go much. Same with prices: more traders pushing means farther moves.

Interpreting Volume and Price Action

Let’s talk about volume and price. They go hand in hand. Think of volume as how loud the market talks. High volume yells, “This is important!” while low volume just whispers. You’ll want to listen when the market is loud. This means lots of coins are trading hands.

In crypto, price action is king. It’s the real deal, showing you exactly how prices move. Each candle on the chart tells you a story of the fight between buyers pushing prices up and sellers pushing them down. The one winning shows where the price could go next. See a candle with a long lower shadow and a small body? It shows sellers tried to push down, but buyers won. This is called a ‘hammer’, and it often means the price might rise.

You also see candles stand in patterns. These are like secret handshakes, telling you what traders might do next. When candles make ‘higher highs’ and ‘higher lows’, buckle up for an uptrend. When they do the opposite, a downtrend may be coming.

But remember, trends can trick you. They can switch fast. Always watch closely and get ready to act.

In crypto, prices move up and down all the time. By reading these patterns and understanding the volume, you can better guess where the price goes next. Use this as your guide. It might lead you to smarter trades and keep your coins safe from bad moves. Now that you’ve got the basics, dive deeper into tools like moving averages, RSI, and MACD to sharpen your edge in the crypto sea. Just know, charts are your best friend in this game of highs and lows. Keep your eyes on them, and they’ll help you stay ahead of the waves.

Integrating Core Technical Indicators for Optimal Trading

Moving Averages as a Trend-Following Tool

A big part of crypto trading is spotting trends. Moving averages help a lot here. They smooth out price action. This means you can see the trend without the noise. There are different types of moving averages. Simple Moving Averages (SMA) are the average price over a set time. Exponential Moving Averages (EMA) put more weight on recent prices.

For example, when a short-term moving average crosses over a long-term one, it’s often a buy sign. This is called a ‘golden cross.’ When it crosses under, it’s a sell sign, a ‘death cross.’ Knowing this can help you ride the trend.

Applying moving averages in crypto trading is straightforward. Chart them on your crypto price chart. Watch how they interact with the price. Look for those crosses. They guide you on when to get in or out of a trade.

The Power of MACD and RSI in Momentum Trading

Momentum is key in picking good trades. Two tools help traders spot this in the market: MACD and RSI.

Let’s start with MACD, which stands for Moving Average Convergence Divergence. The MACD shows you how two moving averages relate to each other. When MACD lines cross, it might mean the market’s momentum is changing. This helps you decide when to buy or sell.

Another tool is the RSI, or Relative Strength Index. It ranges from 0 to 100 and shows if crypto is overbought or oversold. Over 70 is overbought. Below 30 is oversold. This can alert you to a trend reversal.

Finding divergence in RSI is a cool trick. It’s when the price and RSI don’t match up. Say the price hits a new high, but RSI doesn’t. That could mean the momentum is weakening. Knowing this could stop you from buying right before a drop.

Using these indicators takes practice. Start by adding the MACD and RSI to your charts. Watch how they move with the price. Spotting key signals can take time, but it’s worth it. They can tell you so much about where the price might head next.

Remember, there’s no sure thing in trading. But smart traders use tools like these to make better guesses. Moving averages, MACD, and RSI are just the start. But get them right, and you’re on your way to smarter trades. Keep your eyes on these tools. Practice them. And maybe watch your trades get better day by day.

Enhancing Strategies with Advanced Technical Tools

Utilizing Bollinger Bands and Fibonacci for Precision

Bollinger Bands and Fibonacci levels help traders spot turn points in the market. They work great for swing trading and day trading in cryptos.

Bollinger Bands show a crypto’s price range and volatility. The bands widen in volatile times and shrink when the market is still. To use them, watch when the price hits the bands. A price at the top band could mean the crypto is overbought, while at the bottom it might be oversold.

For Fibonacci retracement levels, traders find major high and low price points. They then draw lines at key percentages. These lines show potential support and resistance levels. If a crypto price drops and hits a Fibonacci level, it might bounce back up.

Using Bollinger Bands alongside Fibonacci can make your trading sharper. You’ll have a better shot at seeing when to enter or exit a trade.

Applying the Ichimoku Cloud for Comprehensive Analysis

The Ichimoku Cloud looks complex, but it’s powerful for seeing market trends. This tool shows support and resistance, and gives buy or sell signals. It paints a “cloud” to show future support or resistance areas.

How does it work? The Ichimoku Cloud combines several indicators. It has moving averages and plots them ahead of time. If the price is above the cloud, the trend is up, and if below, down.

When you check out the cloud’s lines, you’ll want to see if they cross. A cross might signal a new trend. Each line gives clues about the market’s move.

In short, use the Ichimoku Cloud to get a full picture of market action. It’s great for deciding when to buy or sell. It takes some practice, but once you get it, it can level up your trading game.

ByKey using Bollinger Bands, Fibonacci levels, and the Ichimoku Cloud, you can improve your crypto trades. Remember, no tool is perfect. Always look at more than one signal before you act. This way, you reduce risks and up your chances for a good trade.

Executing Trades with Expertise

Combining Indicators for Entry and Exit Points

When you trade crypto, knowing when to get in and out is key. You can’t just guess. You need solid clues from the market. That’s where combining different technical indicators helps. Think of it like putting pieces of a puzzle together. You look at the cryptocurrency chart analysis and spot the right time to make a move.

Let’s dive into applying moving averages in crypto trading. They smooth out price data. This lets you spot trends without the noise. When the price crosses over a moving average, it might be time to enter or exit. This is just a start. Now, add Bollinger Bands. They show you how volatile the market is. If the price hits the top band, it’s maybe too high, and you should think about selling. If it’s at the bottom, it might be time to buy.

Using RSI, or the Relative Strength Index, can also guide you. It tells you when things are oversold or overbought. A high RSI means a crypto might drop soon. A low one? It could mean a rise is coming. Then there’s the MACD, which stands for Moving Average Convergence Divergence. This tool helps you spot shifts in momentum before they happen. It’s like a heads-up for what’s about to come.

But wait, there’s more! The stochastic oscillator is perfect, especially for Bitcoin. It works a lot like the RSI. It measures overbought or oversold levels. Are you seeing a pattern here? These tools are like a team, each with a special role, working together to help you read the market’s mind.

Backtesting Strategies for Reliability and Performance

Now, you have your tools picked out. You have a feeling they will work well together. But how can you be sure? You backtest. This means you take your strategy and use historical data to see how it would have done in the past. Does applying pivot points in your analysis add value? Backtesting will show you.

Backtesting helps you not to waste time on weak strategies. It makes sure you’re ready for the real deal. It’s like rehearsing a play before the opening night. By understanding candlestick patterns in trading through backtesting, you could see how often they give good signals.

Backtesting isn’t just about past wins, though. You want to see every time your plan would have flopped. This teaches you to avoid the same mistakes. With tools like the ATR, for understanding cryptocurrency volatility, backtesting could help you set up better stop-loss points.

Don’t forget, crypto moves fast. So, what worked last year might not work today. Keep backtesting new methods and stay up-to-date with how markets change. If you master this, you’re set. You’ll trade with knowledge, not just hope. And in a world as wild as crypto, that’s a superpower.

We’ve covered a lot in this chat about making sense of crypto charts. First, we looked at spotting patterns and trends, because they show us where things might head next. Then we dug into volume and price action, two keys that help tell a coin’s real story.

Moving on, we talked about using tools like moving averages, MACD, and RSI. They’re like secret weapons for following trends and catching big market moves. Next, we explored advanced stuff—Bollinger Bands and the Ichimoku Cloud. They fine-tune trading so we can make moves with confidence.

Lastly, we went over how combining these indicators can pinpoint the best times to buy or sell. And, we can’t forget backtesting. It’s like a time machine, letting us test our tactics before we risk real cash.

My final thoughts? Master these tools and you’ll trade smarter, not harder. Keep practicing, and you can get really good at reading crypto charts. Here’s to making smart moves and winning trades!

Q&A :

What Are Technical Indicators and How Can They Be Used for Crypto Trading?

Technical indicators are mathematical calculations based on historical trading data such as price and volume, used to forecast future market trends. For crypto trading, these indicators can help traders make informed decisions by providing insights into market momentum, trends, and volatility. Some of the popular indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands.

How Do You Apply Moving Averages When Trading Cryptocurrency?

Moving Averages (MAs) smooth out price data to create a single flowing line, which makes it easier to identify the direction of the trend. In cryptocurrency trading, you can use MAs to signal potential buy or sell opportunities when the price crosses over the MA line. Short-term MAs can help identify quicker market movements, while long-term MAs are useful for spotting long-lasting trends.

Can Relative Strength Index (RSI) Indicator Be Useful for Crypto Investment Decisions?

Yes, the Relative Strength Index (RSI) is particularly beneficial for cryptocurrency trading as it helps measure the speed and change of price movements. An RSI reading above 70 indicates an overbought condition (potential sell signal), while below 30 signals an oversold condition (potential buy signal). RSI is widely used in crypto markets to gauge the strength of a trend and potential reversal points.

What Role Do Bollinger Bands Play in Crypto Trading?

Bollinger Bands consist of a set of three lines: the central band is the simple moving average (SMA) of the asset’s price, and the outer bands are the standard deviations of the SMA. Traders look for the price to touch or cross these bands to identify overbought or oversold conditions. In cryptocurrency trading, Bollinger Bands can help identify volatility and price levels that may act as resistance or support.

How Should Beginners Approach Technical Indicators in Crypto?

Beginners should approach technical indicators in crypto by learning and understanding one indicator at a time. Start with simple ones like Moving Averages or the RSI to get a feel for how indicators can reflect market behaviors. Always use indicators in conjunction with other forms of analysis and never rely on them solely to make trading decisions. Practicing with a demo account or small amounts can be a safe way to get acquainted with using technical indicators in live trading.