In the virtual financial world, the emergence of Ponzi schemes remains a major concern for investors. These projects often promise massive profits without any real basis, leading to financial losses for those who participate. Against this backdrop, the U2U project has attracted significant attention. But is U2U a Ponzi scheme? This article will provide insights into the truth behind U2U Ponzi and how to identify Ponzi schemes in today’s financial markets.

Understanding Ponzi schemes

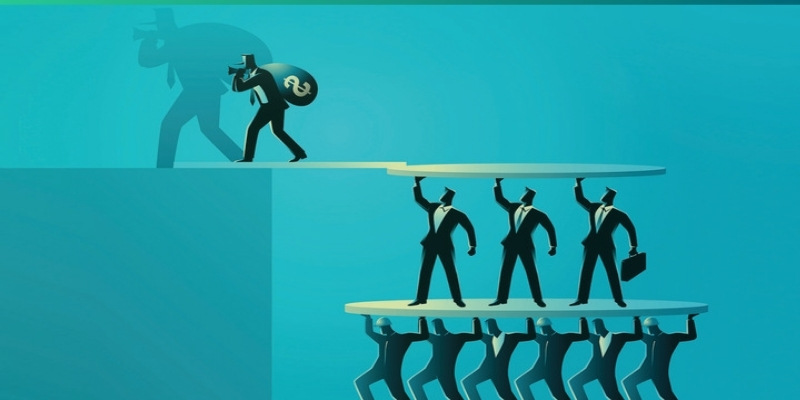

A Ponzi scheme is a term used to describe fraudulent financial plans, where initial investors receive profits from the investments made by later participants. These schemes do not generate real profits from legitimate business activities but instead simply transfer money from new investors to older ones. The term “Ponzi” comes from Charles Ponzi, who became infamous for defrauding investors through illicit investment plans in the early 20th century.

Characteristics of a Ponzi scheme

Identifying a Ponzi scheme is not always easy, especially in today’s virtual financial market, where new projects appear daily. However, these schemes have several distinct characteristics that can help investors avoid risks. Below are the key traits of Ponzi schemes:

Promises of unrealistically high profits: One of the easiest signs of a Ponzi scheme is the promise of extremely high profits within a short period. These organizations often guarantee impossible returns, such as “double your investment in a month,” without any clear basis or legitimate business model to support such claims. Investors are often attracted to these enormous profits without realizing that the money is simply being paid from new investors.

Lack of transparency in operations and finances: Ponzi schemes often lack transparency in their financial reports and investment strategies. The organizers do not allow detailed checks on how they generate profits or fail to provide clear financial statements. This makes it difficult for investors to determine whether they are participating in a legitimate investment plan. Any project that lacks transparency, does not share information about the founding team, or fails to provide a clear development roadmap should be scrutinized carefully.

Inefficient cash flow management: A Ponzi scheme does not generate any real value or profits from legitimate business activities. Instead, the profits for early investors come from the funds of later investors. When the number of participants decreases or is insufficient, the scheme collapses, and investors cannot recover their money. Therefore, an obvious sign of a Ponzi scheme is an imbalance in cash flow: money entering the system does not create real value but simply circulates between participants.

Aggressive recruitment of investors through network marketing: Ponzi schemes often use marketing strategies, particularly network marketing (MLM), to encourage investors to recruit more participants. Typically, these organizations require initial investors to introduce new participants into the system in exchange for commissions or profits. This creates a strong incentive to market and invite new participants, rather than generating actual value from business activities.

Withdrawal issues: Another common feature of Ponzi schemes is difficulty when investors attempt to withdraw their funds. Ponzi organizers often provide excuses for delaying withdrawals, such as “system maintenance,” “transaction overload,” or “time needed to process withdrawals.” Sometimes, investors may not be able to withdraw their money for extended periods or may find it completely impossible to do so because the system no longer has enough funds to pay all investors.

Dependence on the growth of the participant network: A Ponzi scheme can last for a long time as long as it continuously attracts new investors. However, when the rate of new participants slows down, the scheme will begin to face difficulties and eventually collapse. Ponzi schemes typically create a “perpetual cycle” that depends on the ever-growing network of new participants. When there are not enough new participants, the money can no longer circulate, and the system will fail.

Sudden disappearance when the system collapses: When a Ponzi scheme no longer has enough financial resources to continue paying returns to investors, it collapses abruptly. Often, the last investors lose their entire investment, while the first participants may still receive profits. When the system goes bankrupt, the organizers may disappear or cease communication with investors, leaving participants with significant losses.

The above characteristics will help you identify and be cautious of Ponzi schemes. Now, let’s analyze the U2U Network project to assess whether the claim of U2U Ponzi is accurate.

The U2U Network project

U2U Network is a Layer-1 blockchain project designed to develop a decentralized application (dApp) ecosystem. The project aims to address scalability issues in blockchain and focuses on industries such as GameFi, DeFi, and NFTs.

Features of U2U: U2U is designed to solve scalability problems in blockchain through the development of subnet technology. This reduces congestion on the main network and creates independent subnets that manage their own data. This technology enables the U2U ecosystem to operate efficiently and quickly, making it suitable for applications requiring high transaction volumes.

Founding team and long-term commitment: U2U was founded by a team with extensive experience in blockchain and technology. The founders include notable figures in the industry, with experience in developing successful blockchain projects such as KardiaChain and My DeFi Pet. The founders are committed to long-term and sustainable development for the U2U ecosystem, and they are transparent in sharing information about the project’s plans and roadmap.

U2U’s early steps: U2U has made impressive strides in a short period. Products like the U2U Super App and the development of dApps within the ecosystem have already begun to attract the blockchain community’s attention. The project has also received backing from several major investors, which reflects confidence in U2U’s future potential.

U2U’s vision and strategy: U2U focuses not only on building a robust blockchain platform but also on creating a clear vision for developing its dApp ecosystem. The project aims to become one of the leading blockchain platforms for decentralized applications, especially in areas such as GameFi and NFTs.

Is U2U Ponzi scheme?

Based on the available analysis and information, it can be confidently stated that U2U is not a Ponzi scheme. The project has demonstrated transparency in its disclosures and has committed to long-term development. Here are key factors that distinguish U2U from a Ponzi scheme:

Transparency and public information: U2U consistently provides detailed information about the project’s development stages and the founding team. Plans and roadmaps are made public, and the founding team maintains communication with the community through official channels.

No unrealistic profit promises: U2U does not make exaggerated profit promises without a basis. The project’s goal is to build a sustainable blockchain ecosystem, with profits generated from real applications on the platform.

Credible founding team: The U2U founding team has a clear track record and is well-known within the blockchain community. They have experience in developing previous blockchain projects and show a strong commitment to U2U’s long-term growth.

Community and decentralized governance model: U2U promotes a decentralized governance model, where the community can participate in decision-making and project development. This demonstrates transparency and active participation from community members.

After thoroughly analyzing the information about U2U Ponzi, Digicash Blog can conclude that U2U is not a Ponzi scheme. The project has a clear vision, a reputable founding team, and a commitment to sustainable development. Investors can participate in U2U with confidence in the long-term growth and opportunities offered by this blockchain ecosystem. However, as with any investment, investors should conduct thorough research and only invest money they can afford to lose.