In the twisty world of digital coins, safety is king and cold storage is the crown jewels. Finding the right castle to keep your treasure safe is no small feat. That’s why I dove deep into reviews of crypto exchanges with cold storage. You need the scoop on who builds the thickest walls. Each exchange is a different beast, with its own tricks up its sleeve. Get ready for a knight’s tour through a labyrinth of high-tech vaults where your crypto sleeps tight. We’ll tackle who’s nailing it and who might as well be a dragon’s snack. Roll up your sleeves, folks. It’s time to sift gold from the sand.

Evaluating the Security of Top-Rated Crypto Exchanges

The Integration of Cold Storage Solutions

Let’s talk safe money-keeping, just like in the old days with treasure chests, but this time for digital gold. Think of cold storage as the high-tech vaults for your crypto coins. These secure solutions keep your money offline, away from hackers and harm. The big question is, how do these systems stack up?

When choosing a crypto exchange with cold storage, first ask, does it keep most of my digital cash offline? Yes, a good crypto platform stores about 90% or more in cold wallets.

Why is this important? Because access to these funds requires multiple security steps, which beats online hackers trying to make a quick buck of your digital currency.

Now, let’s dig deeper. These platforms often sprinkle a bit of that high-tech dust to create backup layers. Another layer means another lock for cyber-thieves to pick. It’s like keeping your prize possessions in a safe within a safe.

But wait, there’s more. One must check if those cold wallets back up your data too. It’s one thing to lock up your money tight; it’s another to ensure it doesn’t disappear in a puff of data.

Assessing User Trust and Satisfaction

We all like to hear what friends think before we dive into something new, right? Same goes for crypto exchange reviews. People chime in with gold stars or thumbs down, letting us gauge if we’re boarding a sturdy ship or a rickety raft.

So, do users trust these offline storage options? Generally, yes. Those with solid cold storage get loads of virtual high fives. People sleep better knowing their crypto isn’t up for grabs online.

Look for crypto trading places with good user buzz. And not just any buzz, but chatter that’s all about strong locks and keys that don’t break.

But wait, are there actual tales of satisfaction? Yep! Many praise how these nifty cold wallets keep their savings snug as a bug.

Read between the lines of user stories, though. It’s not just about “my money’s safe,” but also “I can get to it when I need to.” The best cold storage won’t make you wait when it’s time to move your crypto.

By now, you can tell that solid cold wallet features can make or break a crypto platform. Check out where you trade – does it boast about their iron-clad offline storage? It should. Reliable crypto storage not only shields your stash from digital pirates but also wins your trust, day after day. That’s why we love those platforms that can wave the flag of cold storage security high and proud, earning stars in the reviews department.

Always choose wisely, as these high-tech treasure chests are not just about locking away your loot, but about peace of mind. Knowing your crypto is snug in cold storage makes jumping into the digital currency sea that much more inviting.

Cold Storage vs. Hot Storage: Understanding the Difference

Comparative Analysis of Security Protocols

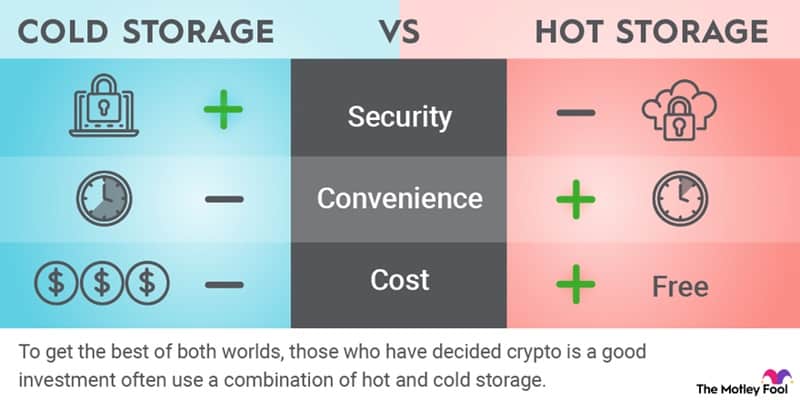

When it comes to keeping your digital cash safe, you’ve got to know two main types: cold storage and hot storage. Cold storage is like a safe locked away from the web. Hot storage is connected, always ready for quick moves. Think of cold storage as your savings account and hot storage as the cash in your pocket.

In online exchanges, cold wallets don’t touch the internet. That makes them tough nuts to crack for hackers. Hot storage, while handier for quick trades, faces more risks. It’s online, so it’s more in reach of sneaky cyber-thieves.

Exchanges work hard to secure your crypto. They set up fancy ways to block unwanted visitors. Offline storage is their top move to keep things safe. They guard this with lots of checks and tricky puzzles.

Now, what’s the big catch with this security thing? Your coins are safer in cold storage. It’s harder for hackers to get there because it’s often offline. No net, less threat – simple as that. And if someone wants to make a big move, like sending a pile of coin, there are extra steps. This slows things down a smidge but boosts security big time.

Real-World Impact on Cryptocurrency Safety

Here’s where it gets real. If your exchange has solid cold storage, your coins are in a good spot. But if it’s mostly hot storage, you’ll want to keep an eye out. Hot storage can be risky. It’s like leaving your car unlocked — not a good idea. So, why does this cold storage thing help? It keeps your crypto out of crooks’ hands best. Your coins are like treasures buried safe and sound.

Let’s talk about big exchanges. Many have strong offline storage. This means when you’re not trading, your money is kept safe, sound, and off the web. This is like having a guard watch your gold all day.

People love it when they feel their money is guarded well. This makes them trust exchanges more. When folks rate exchanges, they look for this safety stuff. They want to be sure their digital gold ain’t easy pickings for bad guys.

But cold storage isn’t just about being safe. It’s also about getting to your money when you need it. Top platforms keep a good balance. They let you trade easily but know to lock up your coins tight when they’re in chill mode.

All in all, using cold storage means peaceful z’s for you. Your coins are like fish in a deep pond — out of reach and doing just fine. When you’re not trading, you want them in that sweet spot — cold storage. Keep them secure until it’s time to dive back into the hot action of the market.

User-Centric Reviews of Cold Storage Features

How Hardware Wallet Integration Enhances Security

What makes hardware wallets so secure for keeping crypto? Simple. They store your keys offline. This means they can’t be hacked through the internet. It’s like a safe that never touches the web. Top-rated crypto exchanges get this. They connect hardware wallets to their platforms. Why? For an extra wall of protection. You plug in your wallet, move funds, and unplug. Your money stays offline but can trade online.

Let’s break it down more. Picture your digital cash in a hardware wallet. It’s like a vault. Now, imagine trading on a crypto exchange with this vault by your side. You get safety and ease. Plus, if a hacker attacks the exchange, you chill. Your funds are snug in your hardware wallet. Those bad guys can’t touch them.

Users dig this feature. They want to control their keys and their coins. Exchanges that offer hardware wallet links get thumbs up. These exchanges understand you want to keep your cryptos safe like gold in a bank.

Platform Reliability and Accessibility for Crypto Storage

Next, let’s chat about trust in a platform. Can you reach your crypto when needed? That’s key. Reliable exchanges ensure you can access your offline crypto storage without a hiccup. These platforms run smooth, like well-oiled machines. Whether trading or checking your stash, you’re in, no sweat.

And they don’t play hide-and-seek with features. Everything is upfront, easy to find, easy to use. That makes life simple for folks new to crypto and vets alike. Reviews praise exchanges that nail this. They make trading and storing digital coins a breeze.

Now, let’s squash a myth that cold storage is a pain to use. Top-shelf exchanges? They marry cold storage with slick tech. The result? Security without losing your cool. They have clear steps, solid support, and mobile apps. So, trading with cold storage doesn’t mean you’re stuck to a desktop.

Remember this. A good exchange thinks about your needs. It ensures that safety, like cold wallets, doesn’t lock out convenience. Reviews that focus on these features tell a tale. Users want both strong walls around their digital gold and doors that swing open with ease.

To wrap it up, crypto exchange security is not just about locks. It’s about reliability and getting to your digital dough with no roadblocks. Good exchanges understand that. They mix tough security with simple access. And they get star ratings from users who say, “Yeah, that’s the stuff.”

The Future of Crypto Exchange Security Measures

Innovations in Blockchain Security Features

Got crypto? Then you know safety is key. When you trade digital cash, you need top-notch security. Think of blockchain like an unbreakable vault. But even vaults need extra locks. This is where cold wallets shine. They’re like a secret bunker for your crypto coins.

With hacks more common, exchanges are fighting back. They’re using super smart tech to keep your cash safe. Picture a puzzle only you can solve. That’s how some new blockchain security works. Only you have the key that fits the lock, no one else.

Exchanges are always upping their game. They add more layers, like a super secure onion. Your coins stay wrapped up tight. No one can touch them without your say-so.

Best Strategies for Protecting Digital Assets with Cold Storage

Cold storage is like a safety net for your crypto. It’s where you can sleep easy. Your coins are off the grid, out of reach of bad guys. When you’re not trading, your digital money sits tight in a cool, secure spot.

Some exchanges have these cold wallets built right in. This means when you trade, your coins jump from the safe to the market – zip zap! It’s smooth, fast, and your coins never linger where thieves can grab them.

Hardware wallets? They’re your own personal safe. Some exchanges let you hook them up right to your account. It’s like having your bodyguard for your crypto coins.

User reviews give us the scoop on trust. People love exchanges with tough cold storage. They give top rates to places that make sure their coins are snug as a bug. They’re trading with peace of mind, and that’s pure gold.

But remember, not all systems are the same. Comparing is smart. Look at what each place offers, how they keep your coins untouchable. Pick the one that feels like a fortress for your funds.

Smart traders know cold storage is a must. It’s not just about having it; it’s about using it right. It’s a puzzle worth solving for anyone who wants their crypto safe and sound.

Exchange rates and security go hand in hand. A place might have all the bells and whistles for trading. But if their cold storage isn’t solid? That’s a deal-breaker. The best spots offer iron-clad cold storage that’s as easy as pie to use.

So what’s the big takeaway? Cold storage is a game-changer. It’s not just an option; it’s the best move for keeping crypto safe. Find an exchange that nails cold storage and you’re set. Your digital treasure gets the stronghold it deserves. Keep your assets frosty, and your crypto adventure will be golden.

In this post, we looked at how top crypto exchanges keep your money safe. We saw cold storage’s role, users’ trust, and how cold storage beats hot storage. We also talked about what real-life crypto safety looks like.

When picking a place to keep your crypto, think hard about security. A hardware wallet linked to an exchange offers solid protection. Make sure the platform is reliable and easy to use. As tech gets better, keeping crypto safe will too. Always use smart cold storage methods. Remember, safety first in the crypto world means peace of mind for you. Stay sharp and keep those digital coins locked down tight.

Q&A :

What Are the Benefits of Using Crypto Exchanges with Cold Storage?

Cold storage refers to keeping a reserve of cryptocurrencies offline, which significantly reduces the risk of hacks and theft that online, hot wallets are vulnerable to. Exchanging platforms offering cold storage provide enhanced security for users’ assets, peace of mind due to reduced cyber threats, and the safeguarding of investments against unauthorized access and potential exchange vulnerabilities.

How Do Reviews Rate the Security of Crypto Exchanges with Cold Storage?

Reviews often rate the security of crypto exchanges with cold storage highly. Users and experts alike tend to appreciate the added layers of security provided by cold storage solutions. The ratings typically reflect the effectiveness of the exchange’s security measures, user experiences, and the platform’s track record in protecting assets against potential breaches.

Which Crypto Exchanges with Cold Storage Have the Best Reviews?

The best-reviewed crypto exchanges with cold storage typically include those that are well-established and have a history of strong security protocols. Exchanges like Coinbase, Binance, and Kraken often receive positive feedback for their use of cold storage and other security measures. It’s important to check the latest reviews and ratings as they can change over time due to updates in service and security features.

Is It Worth Choosing a Crypto Exchange Based on Cold Storage Features Alone?

While cold storage is a critical factor in selecting a cryptocurrency exchange due to its security benefits, it should not be the only consideration. Reviews suggest that other factors like user interface, fees, customer service, and the variety of cryptocurrencies available also play crucial roles in determining a well-rounded and reliable exchange. Combining these elements with cold storage features will give a more holistic view of an exchange’s value.

Can You Trust All Crypto Exchanges That Offer Cold Storage?

Not all exchanges are created equal; even those offering cold storage must be approached with caution. Reviews recommend conducting thorough research, reading user testimonials, and verifying the exchange’s regulatory compliance. Trust in a crypto exchange comes from a combination of features including cold storage, insurance policies, track record, and transparent operating procedures. It is advisable to use diligence and look beyond the presence of cold storage when assessing trustworthiness.