Types of crypto wallets are your gateway to using digital currency. Think of them like different safes for your digital gold. They keep your assets secure and accessible, just like a vault. Some are like a back-pocket wallet, ready at a moment’s notice. Others are your home safe—tough to crack, but not as quick to open. Each has a role to play. And just like picking the right safe for your gold, you need to pick the right wallet for your crypto. Want to dive into the details? Stay with me. Let’s unlock the secrets to safeguarding your digital wealth.

Understanding Cold Storage Wallets: The Fort Knox of Crypto Security

Embrace the Ice: An Exploration of Hardware and Paper Wallets

Cold storage wallets are the safe havens for your crypto coins. Think of them as your personal Fort Knox. They’re not connected to the internet, which means hackers can’t touch them. Hardware crypto wallets look like USB drives but do so much more. They keep your coins locked away, safe and sound.

Using these wallets is like having a secure bank in your pocket. When you need to use your crypto, just connect to a computer and go ahead. When you’re done, unplug and your coins return to their secure state, offline. Paper bitcoin wallet creation is more basic but still safe. You print your wallet details on paper and keep them somewhere no one can find but you.

With hardware wallets, you control your wallet address and keys. No need to trust someone else with your crypto. Even if you lose the hardware, a seed phrase and recovery system lets you get back your coins. Keep that seed phrase locked up too – it’s as good as gold.

The How and Why of Air-Gapped and Encrypted Wallets for Digital Assets

But why bother with these cold storage wallets? Hot wallets, like those on your phone, are easy to use but also easy targets for theft. Consider air-gapped wallets, which never make contact with the internet. They are cold storage champions, keeping your digital currency security tight. It’s like having an unbreachable airlock between your money and the online world.

Encryption turns your wallet into a puzzle that only you have the key to solve. This isn’t just any encryption, it’s advanced, military-grade stuff. Your coins stay hidden behind this wall of codes that only you can unlock. And encrypted wallet for digital assets is essential in a world where online dangers lurk around every corner.

Remember, good security is about layers. Both hardware and paper wallets need a backup plan. Always have copies of your seed phrase or private key in a secure place other than where you keep your wallet. That way, if disaster strikes, you can restore your wallet and not lose a single coin.

Deciding between cold and hot storage is all about how you use your crypto. If you plan to save it and watch it grow, go for the icy shield of cold storage. But if you’re using your crypto day-to-day, a hot wallet might serve you better, as long as you’re aware of the risks and take steps to protect your digital gold.

Navigating Hot Wallets: Convenience with Caution

The Balancing Act of Mobile, Desktop, and Web-Based Wallet Execution

Hot wallets are like the wallets in your pocket. They make it easy to spend and trade your digital currency. But just like in the real world, you wouldn’t walk around with all your money in your pocket. That’s because hot wallets are connected to the internet. This connection makes them handy, but also more open to risks.

When you use a mobile cryptocurrency wallet, you get the freedom to access your coins from anywhere. It’s like having a mini bank right in your phone. Desktop crypto wallets offer a bit more control. They’re stuck on one computer but can be safer since you decide which software to trust. Web-based wallets for crypto can be really convenient, allowing you to log in from any device. But they also need the most caution as they rely on a third-party service.

Remember, hot wallets are super for day-to-day use, but don’t keep all your coins in one spot. Just like you don’t carry all your cash with you.

Evaluating Hot Wallet Risks and the Importance of Secure Crypto Wallet Backup Strategies

Hot wallets come with their share of risks. Hackers are always trying to sneak into systems. But don’t worry, we’ve got your back. Here’s the deal: always back up your wallet. If your phone or computer dies, your coins might too. So, keep that backup safe, like in a locked drawer or a safe box.

Now about backing up: you’ll hear about a seed phrase and recovery. These are the magic words that bring your wallet back if it’s lost or broken. Picture them as a special key only you should know. Write them down on paper and keep it somewhere only you know.

But here’s the trick. Don’t just back up your wallet once. Do it often, keep it safe, and you’ll be golden. Every backup protects your money from tech hiccups.

One more tip: don’t just keep an eye on your wallet. Watch out for the trustworthiness of your wallet providers. Ask around and research. Good providers are like sturdy locks on your door.

Remember, hot wallets are great for ease and speed. But they need a bit of caution, just like crossing a busy street. Back up, choose wisely, and keep only what you need ready to use. Your digital gold will thank you.

Multilayered Security in Multi-Currency Wallets

Custodial vs Non-Custodial Wallets: Who Holds the Key to Your Digital Gold?

Think of your crypto like treasure. You need a safe place to store it. You can keep it in a custodial or non-custodial wallet. Custodial means a company holds your keys. Non-custodial means you hold them. Each has its pros and cons.

Do you control the private keys in a custodial wallet?

No, you don’t control the private keys in a custodial wallet. The company does.

This matters because those keys are like the keys to your safe. If you don’t have them, someone else does. That can be risky. They can access your crypto. But, it can be handy too, for new users. You can let them take care of the tricky parts. Like keeping your wallet safe from hackers.

Non-custodial wallets are the opposite. They put you in charge. That means safety rests on your shoulders. It’s great for control but means you have to be extra careful. Lose your keys, and you lose your coins.

Decrypting Multi-Coin Wallets: Ensuring Compatibility and Cross-Platform Functionality

Now, let’s talk about multi-currency wallets. They are like a magic bag. They hold many types of coins. Not just one, like lots of old wallets. This is where it’s important to talk about compatibility.

Can a multi-currency wallet hold any type of cryptocurrency?

No, not every type. But many of them, yes.

Multi-currency wallets support many coins and tokens. Not all, but a lot. This is great because you can manage all your coins in one place. No need for many wallets; one does the job. It makes your life simpler.

These wallets work across different devices too. Your phone, your laptop, your tablet. You can see your coins everywhere. This is super handy if you use crypto a lot.

But, make sure your wallet is secure! Good ones have strong security. Like encryption that scrambles your data so hackers can’t read it. Always pick wallets with strong security. It keeps your coins safe. And peace of mind? Priceless.

Remember, storing your coins can be safe and simple. Choose the right wallet and protect your digital gold. It’s all about being smart with your choices. Stay in control, stay secure, and your crypto journey will be a lot smoother.

Biometrics and Blockchain: Advanced Wallet Features for the Modern User

The Rise of Biometric Cryptocurrency Wallets and Enhanced User Authentication

Biometric cryptocurrency wallets are a big deal. They let us use body features—like fingerprints or faces—to keep our crypto safe. This means no more forgotten passwords! You just use a part of you, like your thumb, to get into your wallet. This wallet type uses top tech to make sure it’s really you. They’re like your personal crypto guards.

Why biometrics? It’s simple. Your features are yours alone. No one else has your fingerprint or eye pattern. By using these traits, we add a huge security layer. Imagine a lock that only opens with your print or face. It’s that personal. And because of this, hacking gets way, way harder.

Harnessing Blockchain Wallet Features for a Seamless and Secure User Experience

Now, let’s talk about blockchain wallet features. These features make buying, storing, and sending digital money easy and safe. First off, wallet addresses and keys let us manage our money without risk. A wallet address is like your crypto P.O. box, and keys are like your secret codes to unlock the cash.

But there’s more. For example, HD wallets and determinism. This sounds fancy, but it’s about making new addresses each time you get crypto. This keeps your activity private and secures your funds more with each use. And, it all happens in the background!

How about multi-coin support? Many wallets let you handle more than one kind of crypto. This feature means you can keep Bitcoin, Ether, and others all in one place. It’s like a digital multi-tool for your crypto.

Finally, wallet encryption methods. This is about turning your sensitive info into a secret code that only you can read. Strong encryption keeps prying eyes away from your digital gold.

So biometrics and blockchain features in wallets are here to up our crypto game. They give us ways to keep our digital treasure out of the wrong hands, while making sure using crypto stays as snappy as sending a text. Cheers to that!

In this post, we dived deep into crypto wallets. We checked out cold storage wallets, your secure bet like a digital Fort Knox. We explored hardware wallets and paper wallets. These keep your digital cash safe from online threats.

We also looked at hot wallets. These are great for quick access but come with risks. I spoke about how mobile, desktop, and web wallets work and why backing up is key.

Then, we talked about managing multiple currencies. I explained the difference between custodial and non-custodial wallets and how multi-coin wallets work.

Lastly, we explored cutting-edge tech like biometric security. Such features make using blockchain wallets smooth and safe.

Here’s my final thought: Pick the right wallet, and you’re golden. Whether it’s ice-cold storage or the ease of a hot wallet, your choice must fit your habits and needs. Stay informed, stay secure, and your crypto journey will be solid.

Q&A :

What are the main types of cryptocurrency wallets?

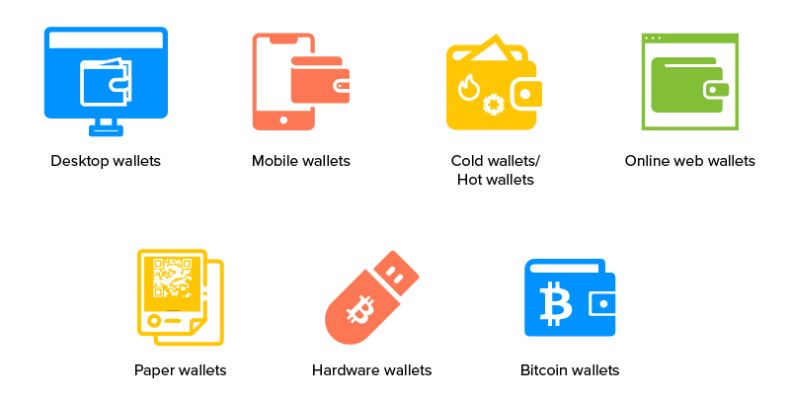

There are several types of cryptocurrency wallets, each serving different needs and offering varying levels of security and convenience. The main types are:

- Hot Wallets: Online wallets that require an internet connection, such as web wallets, mobile wallets, and desktop wallets. They are user-friendly but less secure against online attacks.

- Cold Wallets: Offline wallets that provide higher security as they remain disconnected from the internet. Examples include hardware wallets and paper wallets.

- Hardware Wallets: Physical devices that securely store the user’s private keys. They can be plugged into a computer to access cryptocurrencies safely.

- Paper Wallets: Physical documents that contain a public address for receiving cryptocurrencies and a private key that allows spending or transferring crypto stored in that address. They are considered cold storage.

- Custodial Wallets: Wallets where the private keys are held by a third party, like a cryptocurrency exchange. They are convenient but involve a trust factor.

- Non-Custodial Wallets: Wallets where the user retains control of their private keys, ensuring full control over their cryptocurrency assets.

How do I choose the best crypto wallet for my needs?

Choosing the best crypto wallet depends on your priorities, such as convenience, security, and control. Consider the following factors:

- Usage: If you frequently transact, a hot wallet like a mobile or desktop wallet may be most convenient.

- Security: For large amounts of cryptocurrency, a cold wallet like a hardware wallet offers increased security.

- Control: If retaining full control over your keys is important, a non-custodial wallet is preferable.

- Mobility: If you require access to your funds on the go, mobile wallets are practical.

- Functionality: Some wallets offer additional features like swapping tokens or interacting with decentralized applications.

Research and compare wallet types based on these aspects to find the one that suits your requirements.

Are hardware wallets more secure than other types of crypto wallets?

Yes, hardware wallets are generally considered more secure than other types of crypto wallets. As cold storage devices, they store the user’s private keys offline, making them immune to online hacking attempts. Transactions are signed within the device and then broadcasted to the network, minimizing the risk of key exposure. Although they are not invulnerable to all types of threats, they are a strong line of defense against the majority of attacks aimed at online (hot) wallets.

Can I have multiple types of cryptocurrency wallets at the same time?

Absolutely, it is common for individuals to use multiple types of cryptocurrency wallets to take advantage of the unique benefits of each. For example, one might use a hardware wallet to store large amounts of cryptocurrency securely, while also using a mobile wallet for daily transactions. Using multiple wallets can be part of a broader strategy for managing and diversifying the risk associated with holding digital assets.

What’s the difference between a cryptocurrency wallet and an exchange?

A cryptocurrency wallet is a digital tool that allows you to store, send, and receive digital currencies. Wallets keep your private keys, which are necessary to access your cryptocurrency. In contrast, a cryptocurrency exchange is a platform where you can buy, sell, trade, or exchange cryptocurrencies. Exchanges typically provide custodial wallets where they manage the private keys on behalf of their users, whereas a personal cryptocurrency wallet gives you full control over your keys and assets.